Award-winning PDF software

Printable Form Instructions 4797 Maine: What You Should Know

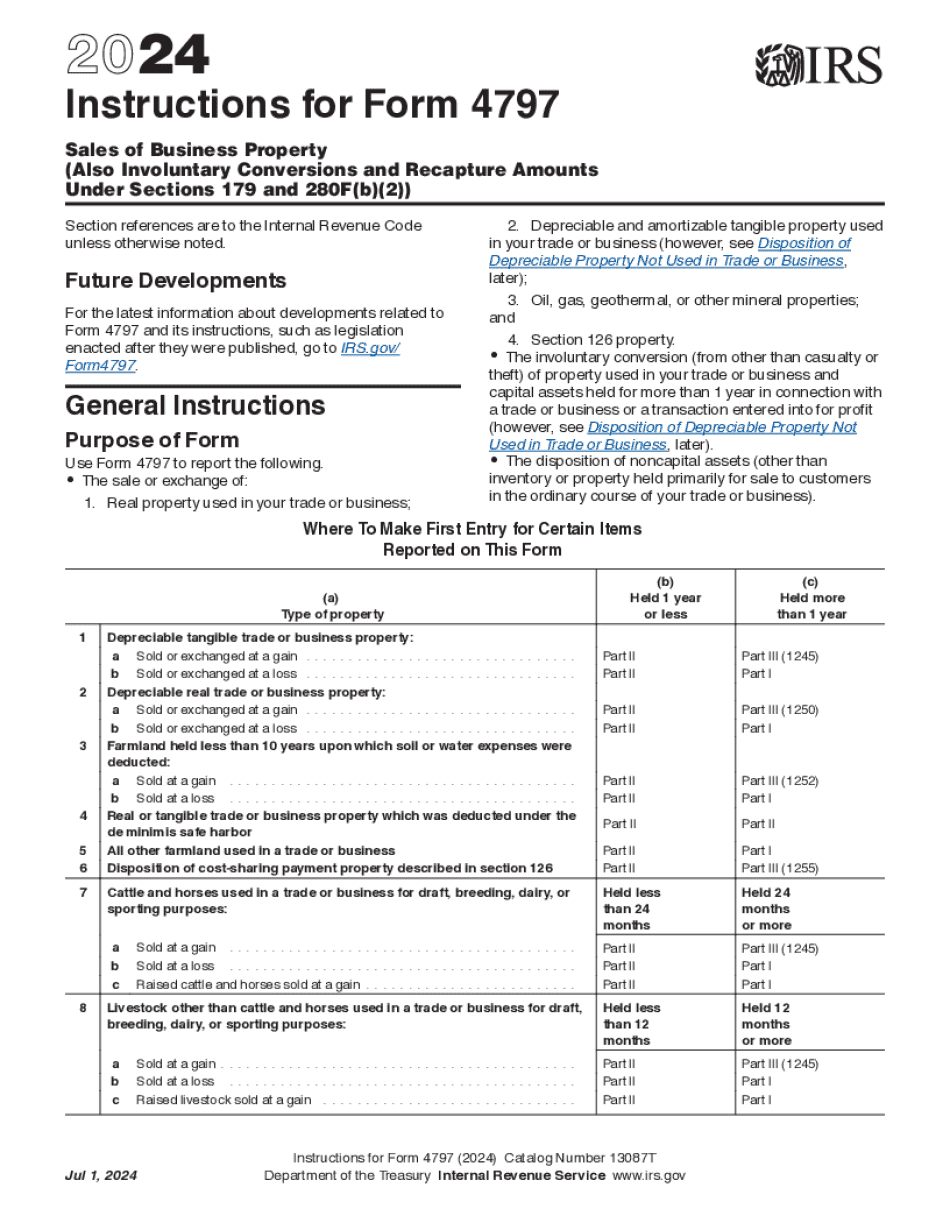

If you're filing on paper, you'll need to sign and date the return. Complete “retardation information for returns,” as directed by IRS, which means you'll need to report any “gains” (profits) and “losses” from your sale of Maine property. See also, Maine Income, Tax, and Local Taxes, a page on the IRS website. What is a “loss” from the sale of Maine property? A loss of Maine property is from the sale of Maine property to someone who is not a resident of Maine (for example, through a gift, inheritance, or casualty). A gain is from the sale of all Maine property sold to a resident. Excluded Property List. (Also Reimbursed Expenses and Losses. Under Section 1231). This list of property that is not subject to local taxes. It includes real estate owned by others, buildings, machinery that can be used in Maine, boats located in Maine, fishing implements, fish, wildlife and fish products. There are other exceptions. For a paper-work-reduction act (PRT) notice, see instructions. Note that: Not all items on this list are eligible to be on Schedule D in Maine. Some of these may not be eligible for PRT on the Maine schedule in general, or in Section 1231 only. If there is more information specific to the property in question, you should check the return with which Form 990-T was filed to determine whether an exception to the exclusion applies. Losses resulting from casualty losses can still apply to other Maine residents who may receive PRT. Losses from the sale of property not covered by this list will not. Sales of Business Property. (Also Involuntary Conversions and Recapture Amounts. Under Section 179 and 280F(b)(2)). Section 179 Property Sale A property sale is where one individual transfers certain property (or other property) to another individual that is a resident of Maine. This includes property transferred in trust, from an estate, or from a person who has been a resident of Maine and who dies. If you bought real estate in Maine: You can avoid sales tax if you made a payment (in full or partial) to transfer the lease or property title. Your payment should be entered on Schedule B, Line 1 or Schedule B-EZ in box 1 of a check you wrote to the seller (not sure which you made the payment through?).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form Instructions 4797 Maine, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form Instructions 4797 Maine?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form Instructions 4797 Maine aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form Instructions 4797 Maine from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.