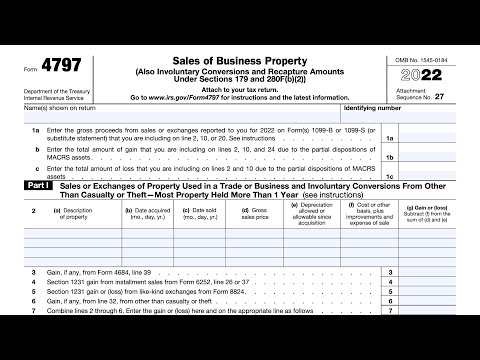

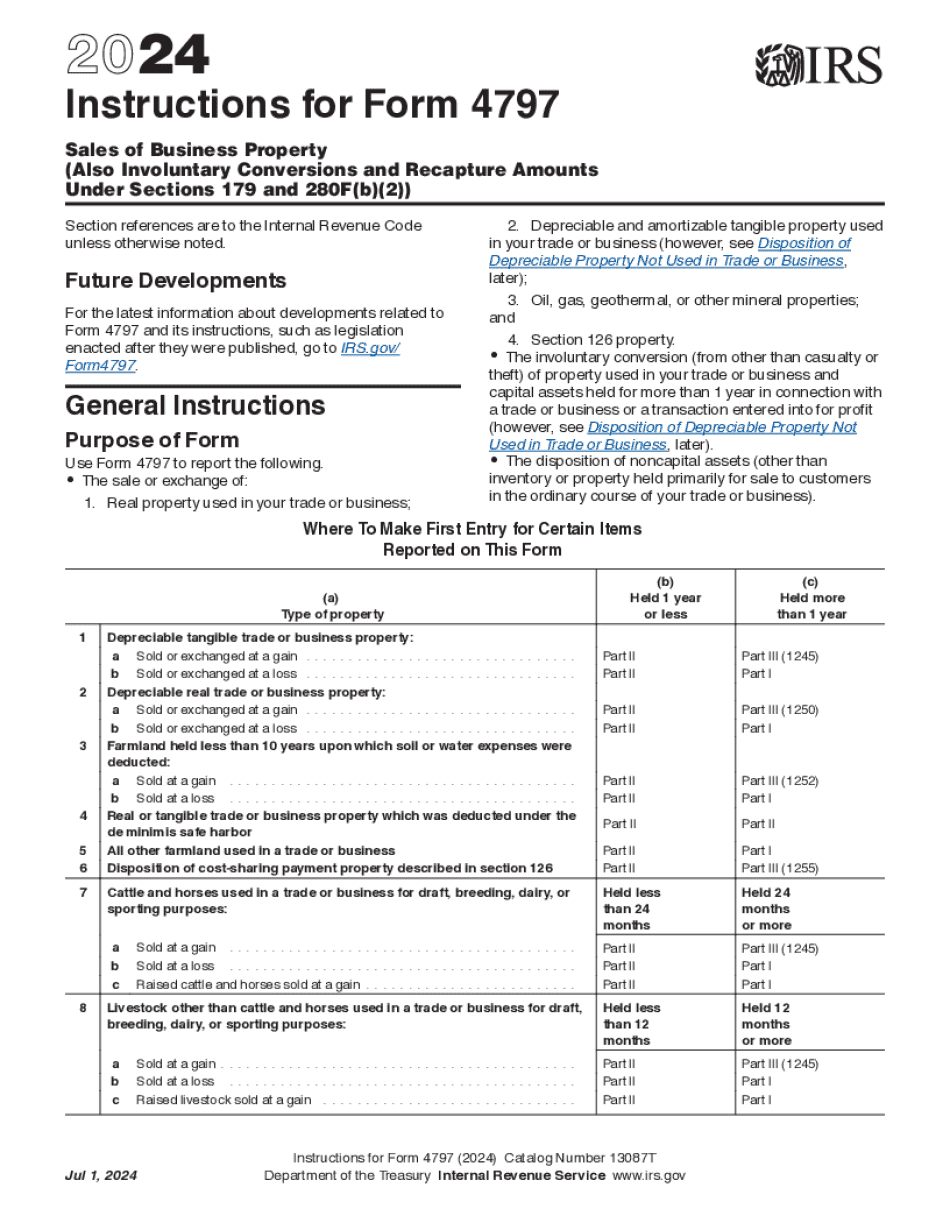

Will be going over IRS form 4797 sales of business property taxpayers will use this form for a couple of reasons primarily to to report the sale or exchange of certain property used in business in your Trader business so such as real property depreciable and amortizable tangible property oil gas geothermal and mineral Properties or section 126 property this form is also used to report involuntary conversions of property used in your trade business that were held for more than one year the disposition of non-capital assets disposition of capital assets that are not already reported on Schedule D the gain of loss gain or loss for partners and shareholders of s corporations from certain Section 179 Property Disposition I recapture amounts under either Section 179 or section 280f or gains and losses treated as ordinary gains trade gains and losses if you are a Securities Trader or Market uh Market in Commodities and you made a mark to Market election finally you might use this form to defer a qualified section 1231 gain invested in a qualified opportunity fund this might not be the only form that you have to file based on the circumstances of your disposition of property so you may need to use IRS form 4684 casualties and thefts if you're reporting any involuntary conversions due to a casualty or theft you may need to use IRS form 6252 installment sale income to report the sale of property under the installment method you may need to use form 8824 like kind exchanges to report exchanges of qualifying business or investment property and if you sold property for which you received an investment credit that you may need to file form 4255 recapture of investment credit uh depending on the nature of the property you're selling...

Award-winning PDF software

How to prepare Form Instructions 4797

About Form Instructions 4797

Form Instructions 4797, formally known as "Instructions for Form 4797, Sales of Business Property," is a document provided by the Internal Revenue Service (IRS) in the United States. It is meant to provide guidance on how to complete Form 4797, which is used to report the sale or exchange of business property. The form and its corresponding instructions are primarily intended for taxpayers who have sold or disposed of business property during the tax year. This includes individuals, partnerships, corporations, and other entities engaged in business activities. The purpose of Form 4797 is to calculate and report the gain or loss on the sale or exchange of such property. The instructions aim to assist taxpayers in correctly completing each section of Form 4797, including the identification of the property, calculation of any gains or losses, determination of depreciation allowances, and reporting of assets used in a trade or business. By following Form Instructions 4797, taxpayers can ensure they accurately report their gains or losses from business property transactions, facilitating compliance with tax laws and regulations.

What Is Form 4797 Instructions?

Online solutions help you to arrange your file administration and raise the productiveness of the workflow. Look through the quick information as a way to fill out Irs Form 4797 Instructions, avoid mistakes and furnish it in a timely way:

How to complete a Form 4797 For?

-

On the website hosting the blank, click Start Now and go towards the editor.

-

Use the clues to fill out the suitable fields.

-

Include your individual data and contact details.

-

Make absolutely sure you enter correct details and numbers in correct fields.

-

Carefully revise the content of your blank so as grammar and spelling.

-

Refer to Help section should you have any issues or address our Support staff.

-

Put an electronic signature on the Form 4797 Instructions printable with the help of Sign Tool.

-

Once document is done, press Done.

-

Distribute the prepared by means of email or fax, print it out or save on your device.

PDF editor will allow you to make improvements in your Form 4797 Instructions Fill Online from any internet connected device, customize it in keeping with your needs, sign it electronically and distribute in several approaches.

What people say about us

How to submit templates without mistakes

Video instructions and help with filling out and completing Form Instructions 4797