Laws.com provides a legal forms guide, including Form 8283, which is used by the United States Internal Revenue Service (IRS) for reporting non-cash charitable contributions over $500. - This form is specifically for reporting the donation of property, not time or funds that are cash-based. - To obtain Form 8283, you can either visit the IRS website or obtain the documents from a local tax office. - When submitting your regular income tax return, include Form 8283 only if you are claiming a deduction of more than $500 for all property donated to a charity. - Section A of the form should be used if the property value is under $5,000, while Section B should be used for items valued over $5,000. - Your name and tax identification number should be provided at the top of the form, along with your social security number or corporate tax identifier in Part 1. - For each organization to which you donated property, provide their name, address, and a description of the donated property. - If you donated a car, provide a detailed description including the VIN number and mileage. - The donation details should include the dates of transfer, method of donation, donor's cost basis, fair market value of the property, and how the fair market value was determined. - Complete this information for each item donated. - Part 2 is used when you didn't donate a complete interest in the property, such as partial donations of land or jointly held property. - In Part 2, provide the name of the property donated, the percentage of ownership granted, the property's location, the total amount claimed as a deduction in the prior year, and any restrictions attached to the donation. - Section B in the Form 8283 is used to claim a deduction for property valued over $5,000. - Like Section A, Section B should be...

Award-winning PDF software

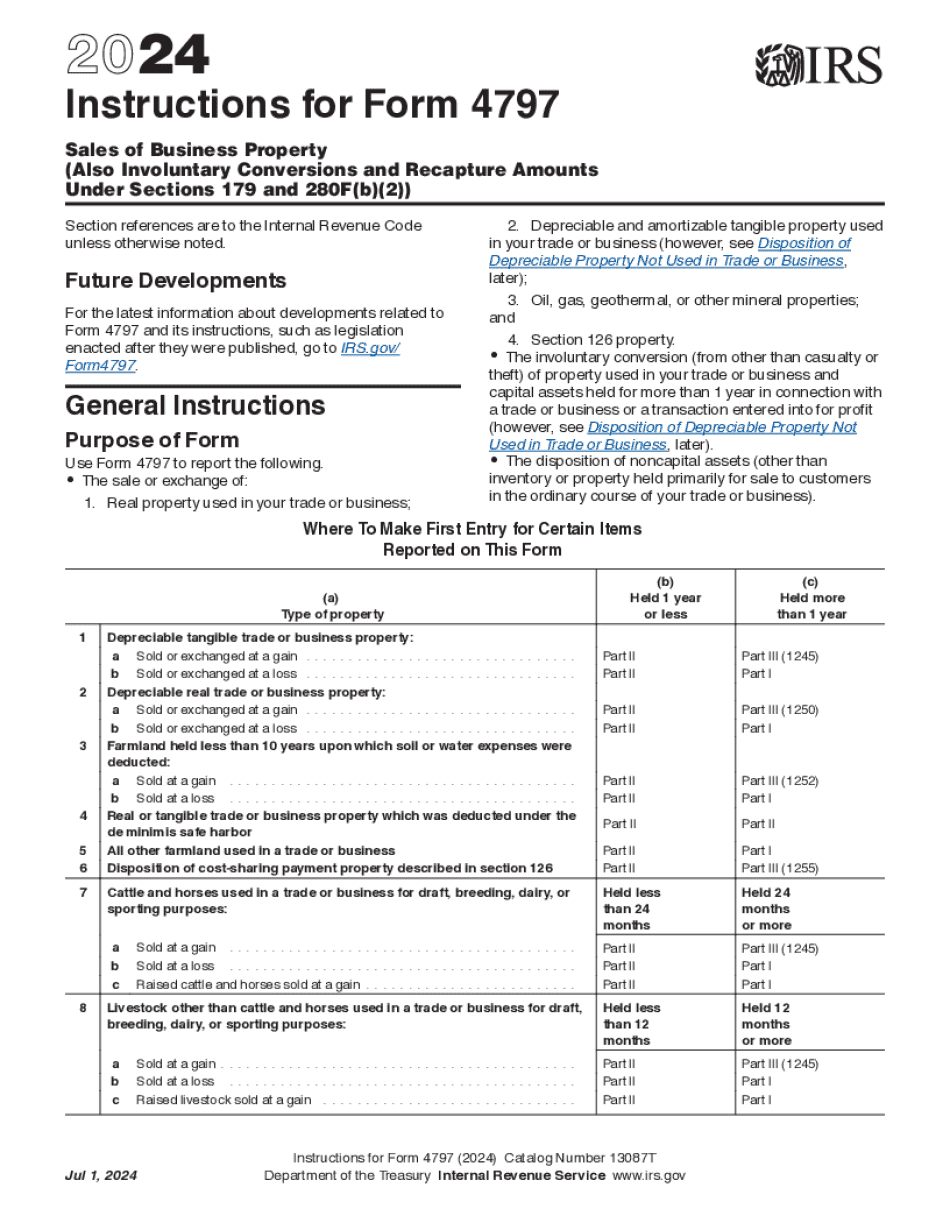

4797 Instructions 2024-2025 Form: What You Should Know

MICHIGAN ANNUAL INCOME TAX RATES Complete the following Schedule A-1 and include the statement of the annual percentage rate for 2018. Form 4797, Part III — Gain or Loss on Sale or Exchange of Asset Used in a Trade or Business (2018 Edition) You should only complete this form if you sell certain items or exchanges of other items of value to another person. Complete Part III using only line 23 of Schedule D-1 (Form 1040). Note: Some assets sold using this form are subject to the 15% additional tax (see line 30 of Part III). 2021 CERTAIN FINANCIAL STATEMENTS Complete Form 4797-X, Miscellaneous Income, and attach part VI of Form 4797 using line 37. Attach Form 3117, Medical Account Balance Losses for 2018, to this form. 2021 ANNUAL INCOME TAX STATEMENTS These statements report your total self-employment income for your tax year (2017). 2021 CERTAIN FINANCIAL STATEMENTS These statements report your total self-employment income for your tax year (2018). 2021 ANNUAL INCOME TAX STATEMENTS You may owe additional tax on the gain on the sale or exchange of property used in a trade or business. File line 33 of your Schedule D-1 or Schedule EZ of Form 1040. This amount may be due in 1041 and 1042 and is not due on Schedule C-EZ. Filed by: Filed for: Actions: H.R. 631 Actions: H.R. 6033 Actions: H.R. 604 Actions: H.R. 603 Actions: H.R. 650 Actions: H.R. 644 Actions: H.R. 641 Action: BILL H.R. 631 (114th) Actions: H.R. 360 (116th) Actions: H.R. 643 (108th) Actions: H.R. 639 (119th) Actions: H.R. 634 (118th) Actions: H.R.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 4797, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 4797 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 4797 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 4797 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4797 Instructions 2024-2025