Award-winning PDF software

Form Instructions 4797 for Georgia: What You Should Know

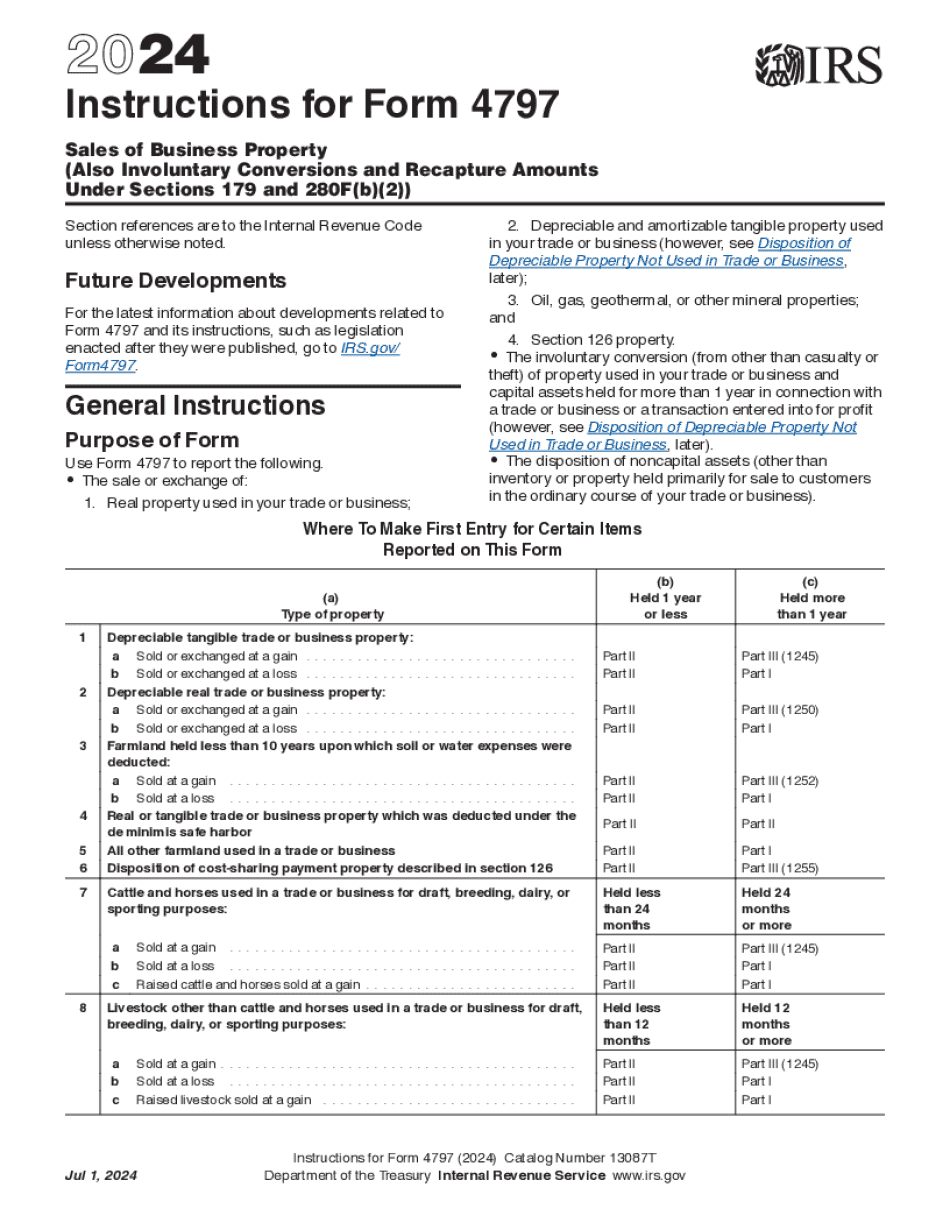

Lloyd Marcus, Inc. | 6th Floor | P.O. Box 56711 | Atlanta | Georgia 30303 | 404.679.7790 Contact: LoydMarcuslmgt.com Phone: 404.680.7955 Sep 5, 2025 — Form 4797 is used to report: The sale or exchange of: Property used in a trade or business; Property used in a farming or ranching business; Property used to service the general business needs; Property used to develop a resort; Residue from a farm or ranch; Agricultural produce from any of the following: Cultivated under contract not by the landowner; Land cultivated by the landowner under a lease or indenture; Land purchased by a farm or farm organization under contract to raise crops or livestock in the future; Property used to cultivate, test, plant or harvest crops; Property that is used to plant seed and plant. Property used in the business of selling or renting property to individuals or individuals who use the property as their own. Real property in this business including: A building and the land on which a building stands; A house and land on which the house is located; A farm and its improvements; A farm or other land owned by you used in a farming or ranching business and land you plan to use, or have plans to use, solely for business; Subdivision of non-farm land; and Subdivision of farm or farm organization property. Any other sale on which business interests were involved, that includes, but is not limited to, sales of personal property, or sales of motor vehicles valued at more than 250; and The involuntary conversion of property. The recapture amount is included on line 31 (and line 13) of Form 4797. See the Income Tax Federal Tax Changes | Georgia Department of Revenue Form 7-INVEST (International Transfer of Capital) Form 7-INVEST (International Transfer of Capital) is not to be completed by you until you have obtained the advice of a qualified tax advisor who is willing to complete the form in your absence. Form 7-INVEST (International Transfer of Capital) may be used solely for foreign direct investment in certain qualified investment opportunities. You may not use Form 7-INVEST (International Transfer of Capital) to acquire other types of capital property unless you are aware that you qualify as a foreign tax credit recipient under federal rules.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instructions 4797 for Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Form Instructions 4797 for Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instructions 4797 for Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instructions 4797 for Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.