Award-winning PDF software

Form Instructions 4797 California San Bernardino: What You Should Know

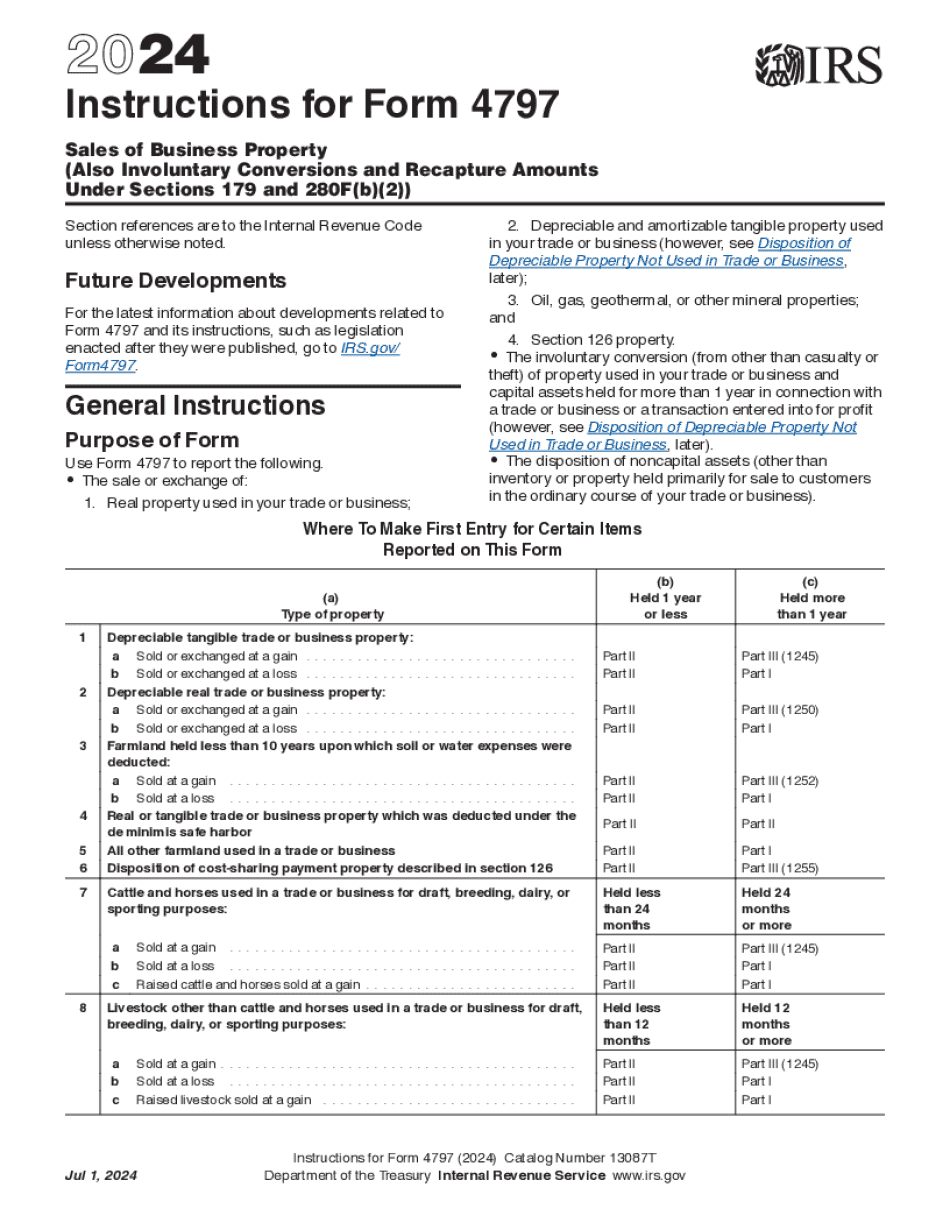

You should be aware that even though you'll be reporting the gross cash flows from real estate purchases to the IRS, you should also estimate the total value, as well as the property tax due on the property at the time of the purchase. You should make estimates of these values using California tax rate and the sales price, and if the price is greater than the California gross income limit, use it to calculate your overall real estate tax. We'll start with the actual price realized on the property at the purchase date or the actual price from the sale at whatever is lower. 2021 Instructions for Form 100B To determine the taxable purchase price of a California real property, add, without limit, all cash payments or property other than cash payments from the purchaser that are more than the gross cash flows. There are no limits to the cash payments. For Example, If you made the purchase with a down payment of 100% and the actual purchase amount was 350,000 and your net cash flow was 200,000, we would add the down payment of 75,000. For Example, If you made the purchase with an initial down payment of 100% and the actual purchase amount is 350,000 and your net cash flow is 150,000, we would add the initial down payment of 75,000. 2021 Instructions for Form FT 3210 With this form, you can report the total sale proceeds of real property for the calendar year in which the land is sold without regard to whether or not there is a reserve fee on the transaction. The gross proceeds amount, however, will be reported on California income tax forms, if there is a reserve fee. 2021 Instructions for Form 4797 — IRS This Schedule D (Form 4797) shows how much, if any, California business income tax you are expected to pay by calculating California nonresidential gain using the state business tax rate. If you are an eligible taxpayer, this figure should be adjusted for the California gross income limit. This Schedule D (Form 4797) shows how much, if any, California nonresidential gain your net gain or loss from the sale or exchange of property is expected to be by dividing the net gain or loss by the total nonresidential gain or loss from all qualified transfers of real property other than land. This number will be adjusted for the California gross income limit. Note: This calculation does not count property sold during the year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instructions 4797 California San Bernardino, keep away from glitches and furnish it inside a timely method:

How to complete a Form Instructions 4797 California San Bernardino?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instructions 4797 California San Bernardino aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instructions 4797 California San Bernardino from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.